Are you tired of paying too much for car insurance? It’s time to find the best rates for your car. In this guide, we’ll look at what affects insurance costs. We’ll give you tools to save hundreds or thousands on your coverage.

Finding the right car insurance is more than just protection. It’s about knowing how insurers set prices. We’ll help you understand insurance costs better. This way, you can find the best deals for your needs.

Key Takeaways

- Understand the key factors that affect insurance costs for different car models

- Discover how to challenge common misconceptions about auto insurance rates

- Learn to evaluate coverage options and find the right balance between protection and affordability

- Uncover strategies to conduct effective insurance cost comparisons and leverage discounts

- Avoid common mistakes that could lead to overpaying for your car insurance

Ready to control your insurance costs and find the best rates? Let’s start this journey together. We’ll find ways to make your coverage more affordable.

Understanding Insurance Costs for Different Car Models

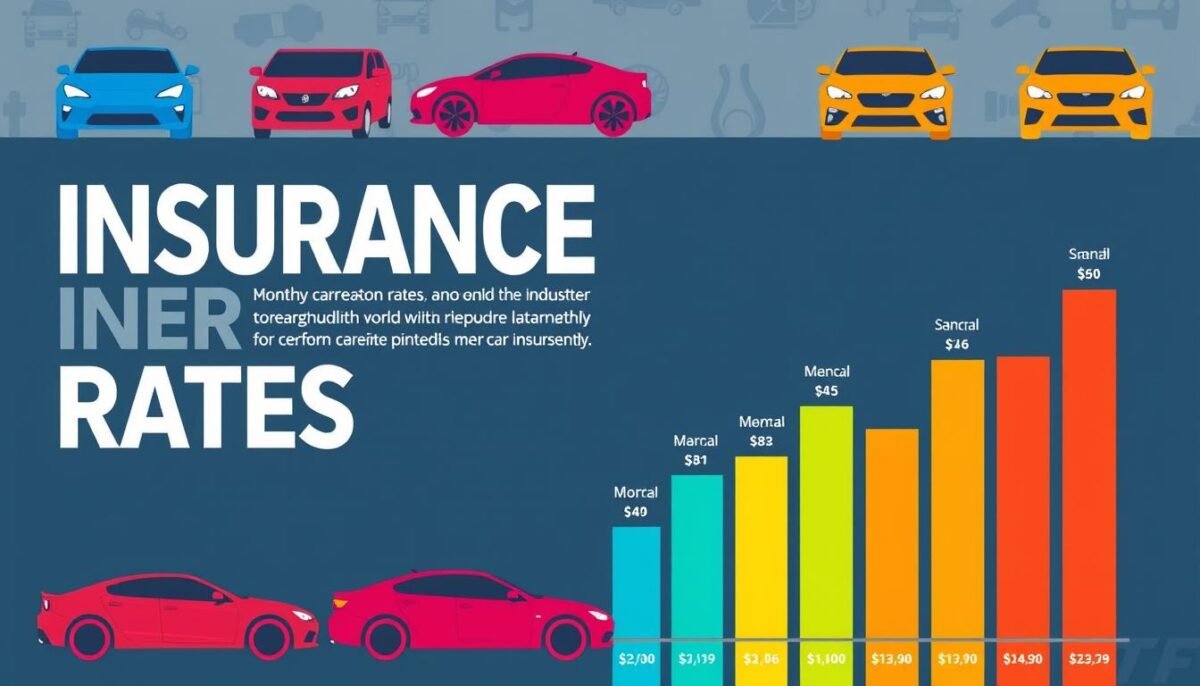

The type of car you drive affects your insurance costs. Tools like the car insurance premium calculator and vehicle insurance price comparison help show how car models impact your rates.

Factors Affecting Insurance Quotes

Several factors influence insurance costs for different cars, including:

- Safety ratings: Cars with high safety ratings cost less to insure. They are less likely to be in accidents or need expensive repairs.

- Repair costs: Cars with expensive parts and repairs cost more to insure. This is because insurance companies worry about the financial burden of fixing them.

- Theft rates: Cars at higher risk of theft cost more to insure. This is because there’s a greater chance of claims for stolen vehicles.

Common Perceptions vs. Reality

Many think bigger, pricier cars always cost more to insure. But it’s not that simple. While luxury and high-performance cars might have higher premiums, some midsize and smaller cars can also be pricey. This is due to theft rates and repair costs.

The Role of Vehicle Safety Ratings

Vehicle safety ratings are key in determining insurance costs. Cars with top safety ratings and features get lower premiums. This is because they are less likely to cause serious injuries and costly claims.

Knowing how different car models affect insurance costs helps you make better choices. This includes picking the right car insurance premium calculator and vehicle insurance price comparison tools.

The Importance of Making Informed Decisions

When looking for car insurance quotes, the car you drive matters a lot. Insurance costs change a lot between different cars. Knowing these differences helps find the cheap auto insurance for Toyota Camry or other cars that fit your budget.

How Premiums Vary by Vehicle Type

Insurance companies look at many things when setting rates. The car’s make, model, and safety features are key. Cars that are more likely to get stolen or cost more to fix usually cost more to insure. On the other hand, cars that are safer and more reliable often cost less.

- Sedans like the Toyota Camry usually cost less to insure than sports cars or big SUVs.

- Cars with safety features like automatic braking or lane-keeping assist can get discounts.

- The age and condition of the car also matter, with newer, better-maintained cars getting better rates.

Assessing Your Needs and Budget

When looking for affordable car insurance quotes, think about what you need and can afford. Consider your driving habits, how many miles you drive, and how much coverage you need. Finding the right balance between coverage and cost is key to getting the best policy for your Toyota Camry or any other car.

“Choosing the right car insurance policy is a crucial financial decision that can have a long-term impact on your finances. Taking the time to understand the factors that influence premiums can help you find the best coverage at the most affordable price.”

Evaluating Coverage Options for Your Car

Getting the best car insurance rates means knowing your options. We’ll look at the main differences between liability and full coverage. We’ll also talk about deductibles and uninsured motorist protection.

Liability Insurance vs. Full Coverage

Liability insurance is the law in most places. It covers damages or injuries you cause to others. But, it doesn’t help with your car’s repairs or replacement.

Full coverage includes collision and comprehensive insurance. It helps you avoid big expenses if your car gets damaged or stolen.

Understanding Deductibles and Premiums

The deductible is what you pay before insurance kicks in. A higher deductible can lower your monthly payments. But, you’ll pay more if you need to file a claim.

It’s important to think about your budget and risk when choosing a deductible and premium. This helps you get the best car insurance rates for you.

Uninsured Motorist Coverage Explained

Uninsured motorist coverage helps if you hit someone without insurance. It’s great in areas with many uninsured drivers. It makes sure you’re not stuck with the bill for an accident.

Knowing about liability, full coverage, deductibles, and uninsured motorist protection helps you choose the right low cost car insurance options. This way, you get coverage that fits your needs and budget.

How to Conduct an Effective Insurance Cost Comparison

Comparing insurance costs for different vehicles can seem hard. But, with the right steps, you can find affordable coverage that fits your needs. Let’s look at how to compare insurance costs effectively and help you make a smart choice.

Gather Necessary Information

To get accurate insurance quotes, you need some key information:

- The make, model, and year of the vehicle you’re looking to insure

- Your personal details, such as your age, driving history, and location

- The coverage levels you require, including liability limits, collision, and comprehensive

- Any discounts or special features you may be eligible for, such as good driver or safety features

Use Online Comparison Tools

Online insurance comparison tools can save you time. They let you input your vehicle and personal info. Then, you can quickly compare quotes from many insurers. Some top choices include Compare insurance costs for different vehicles and insurance cost comparison by car.

Analyze Coverage and Costs Side by Side

When looking at insurance quotes, don’t just look at the price. Check the coverage details, deductibles, and any limits or exclusions. Look at the overall value, balancing cost and protection.

By following these steps, you can compare insurance costs well. This way, you can find the best coverage for your vehicle and budget. Remember, taking time to research and compare can save you a lot in the long run.

Factors that Influence Monthly Premiums

Auto insurance rates can change based on several key factors. Knowing these factors helps you find the right coverage for your car and budget. Let’s explore how your age, driving history, location, and car type affect your insurance costs.

Age and Driving History

Your age and driving history are crucial for insurers. Young drivers, especially those under 25, face higher premiums. On the other hand, experienced drivers with clean records usually get lower auto insurance rates by make and model.

Location and Its Impact on Rates

Your location also affects your car insurance premium calculator. Population density, traffic, and accident rates in your area influence your rates. For example, city dwellers often pay more than those in rural areas.

Vehicle Age and Condition

The age and condition of your car also matter. New, expensive cars have higher premiums because they cost more to replace. Older, high-mileage cars are generally cheaper to insure, as they’re less costly to repair or replace.

| Factor | Impact on Premiums |

|---|---|

| Age | Younger drivers (under 25) pay higher premiums |

| Driving History | Clean record leads to lower rates |

| Location | Urban areas have higher rates than rural regions |

| Vehicle Age and Condition | Newer, more expensive cars cost more to insure |

Understanding these factors helps you choose the right insurance. Review your policy and compare car insurance premium calculator options regularly. This ensures you’re getting the best value for your money.

Discounts and Savings Opportunities

Finding the best car insurance rates is easier when you know about discounts. There are many ways to save money without giving up on coverage. This includes bundling policies, joining safe driving programs, and using vehicle safety features.

Bundling Insurance Policies

One smart way to get affordable car insurance quotes is to bundle your policies. This means combining your car insurance with homeowner’s or renter’s insurance. Insurers give discounts for this because it shows loyalty and saves them money.

Safe Driving Programs and Discounts

- Safe driving programs can lead to big savings. These include defensive driving courses or systems that track your driving.

- By showing you’re a responsible driver, you can get lower best car insurance rates. This can save you hundreds each year.

Discounts for Vehicle Safety Features

Car safety features are important to insurers. They offer discounts for cars with advanced safety tech, like:

| Safety Feature | Potential Discount |

|---|---|

| Anti-lock brakes | 5-10% |

| Airbags | 20-30% |

| Collision avoidance systems | 10-15% |

| Theft deterrent systems | 5-15% |

By using these discounts, drivers can find best car insurance rates that match their budget. They also get the security of good coverage.

Common Mistakes to Avoid in Insurance Comparisons

Finding the best vehicle insurance rates requires avoiding common pitfalls. These mistakes can lead to poor coverage or higher costs. As you explore vehicle insurance price comparison and low cost car insurance options, avoid these errors to make a smart choice.

Focusing Solely on Price

Cost is important, but it shouldn’t be the only thing you look at. Choosing the cheapest policy without considering quality or service can be risky. Make sure to look at the overall value each insurance provider offers, not just the price.

Overlooking Reviews and Ratings

Don’t just trust what insurance companies say. Look for reviews and ratings from trusted sources. These can give you insights into customer satisfaction, claims handling, and financial stability. These are key when choosing the right coverage.

Ignoring State Requirements and Regulations

Each state has its own insurance rules and regulations. Not knowing these can lead to inadequate coverage or fines. Make sure to research your state’s laws and choose a policy that meets or exceeds the minimum requirements.

Avoiding these mistakes and taking a comprehensive approach to vehicle insurance price comparison will help you find the best low cost car insurance options. Stay informed and ask questions. Your financial health and peace of mind are worth the effort.

Timing Your Insurance Purchase for the Best Rates

Finding cheap auto insurance for Honda Civic or comparing insurance costs for different vehicles can be easier if you know when to buy. Understanding when insurance prices change can help you save money. This way, you can get the best rates for your needs.

Seasonal Trends in Insurance Pricing

Insurance rates change with the seasons. Summer rates are often higher because of more traffic and accidents. Winter rates might be lower because driving is safer.

Knowing these trends helps you buy insurance when prices are lower. This can save you money.

The Benefits of Shopping During Renewal Periods

- Leverage competition: When your policy is up for renewal, companies compete for your business. This can lead to better quotes and discounts.

- Avoid lapse in coverage: Renewing on time keeps your coverage continuous. This avoids higher rates or penalties for gaps in coverage.

- Take advantage of loyalty discounts: Insurers often give discounts to loyal customers. Renewing your policy can save you money.

Buying insurance at the right time can save you a lot of money. Whether it’s for a Honda Civic or other vehicles, timing is key. This way, you get the best rates for your needs.

“Timing your insurance purchase can be a game-changer when it comes to finding the most affordable coverage for your vehicle.”

Staying informed about insurance trends and shopping during renewal periods can save you a lot. With some planning, you can get the best deal on your car insurance.

Final Thoughts on Insurance Cost Comparison by Car

Looking into insurance costs for different cars is key to finding great rates. Knowing what affects insurance prices helps a lot. By comparing options and using the right tools, you can choose wisely and save money.

Evaluating Your Choices

When looking at insurance, think about what you get for your money. The cheapest might not always be the best. Think about your driving, car, and budget to choose the right coverage.

The Ongoing Importance of Regular Comparisons

The auto insurance world keeps changing, with rates and policies shifting often. It’s smart to compare insurance costs regularly, even if you’re already insured. This way, you can find new deals and save money.

Staying Informed About Future Rate Changes

Auto insurance rates can change a lot. Keep up with industry news and rate changes. This way, you can stay ahead and get the best coverage for your car.

FAQ

What factors affect insurance costs for different car models?

Insurance costs vary based on safety ratings, repair costs, theft rates, and the vehicle’s risk profile. Engine size, age, and mileage also play a role.

How do premiums differ across vehicle types like sedans, SUVs, and sports cars?

Sports cars and SUVs often have higher insurance costs due to powerful engines. Sedans usually have lower premiums.

What is the difference between liability insurance and full coverage?

Liability insurance covers damages to others if you’re at fault. Full coverage includes collision and comprehensive for your vehicle. Full coverage is more expensive but offers better protection.

How can I find the best car insurance rates for my vehicle?

To find affordable insurance, know your car’s details and driving history. Use online tools to compare quotes from different insurers. Look at coverage levels and prices.

What discounts are available to help lower my car insurance costs?

Discounts include bundling policies, safe driving programs, and safety features. Insurers offer many ways to save.

How does my driving record and personal information impact my insurance rates?

Insurers use your age, location, and driving history to set rates. Young drivers, those with accidents or tickets, and those in high-risk areas pay more.

When is the best time to shop for car insurance?

Renewing your policy is a good time to shop. Insurers often offer better rates to keep customers. Knowing seasonal pricing trends helps find the best deals.

What common mistakes should I avoid when comparing insurance costs?

Don’t just look for the cheapest price. Ignore reviews and state-specific rules. Balance cost with coverage and consider the insurer’s reputation.